By Muhammad Insar

Pakistan’s budget has been announced in the National Assembly. And the question that everyone wants to ask is whether this budget is going to give some relief to the poor, or the situation is going to become worse. There are lots of various aspects of budgets and lots of different statistics, and sometimes it is possible to get lost in all these numbers and cannot realize what is the overall picture. The point to realize is that ever since Mohammad Aurangzeb was appointed as the Finance Minister, macro-economic stability has been his primary objective and this objective coincides with the aims of the International Monetary Fund (IMF).

This objective can be simply outlined in two points that is to ensure the maximization of tax revenue and the minimization of expenditures. More than this, the budget does not have much long-term thinking. These are its main objectives: reducing the fiscal deficit. This is a policy which the IMF has continued to exercise in other parts of the world, and the outcomes are not unknown. To begin with, it must be noted that the government has managed to bring the inflation down to less than 5%, having been above 29%. It was previously 29%, then 23-24%, now it has fallen to below 5%. This is a very low inflation rate. The already existing inflation cannot be switched back and is continuing to weigh on the population, but the additional inflationary pressure has been restrained. The economy has also passed the 410 billion dollars’ mark together with it. Additionally, remittances and foreign exchange reserves have both increased.

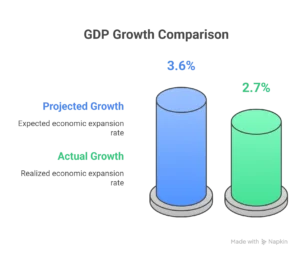

These happen to be the successes of the government and they concentrate on these achievements alone when discussing their developments. However, alongside these successes, there are also significant failures. They had planned a GDP growth of 3.6 percent, yet the economy expanded by 2.7 percent. There are even calls that this should be amended to 2.6 percent. This is not a very high growth rate. The truth is that we are in the same bind since the population of Pakistan increases by approximately 2 percent annually. So, the real growth rate is not very substantial.

These happen to be the successes of the government and they concentrate on these achievements alone when discussing their developments. However, alongside these successes, there are also significant failures. They had planned a GDP growth of 3.6 percent, yet the economy expanded by 2.7 percent. There are even calls that this should be amended to 2.6 percent. This is not a very high growth rate. The truth is that we are in the same bind since the population of Pakistan increases by approximately 2 percent annually. So, the real growth rate is not very substantial.

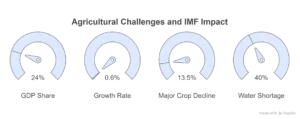

Agriculture, large-scale manufacturing and services are the three main sectors that we need to look at. In agriculture, the overall rate of growth stood at 0.6% instead of the planned 2 per cent. So, agriculture grew far below expectations. The large-scale manufacturing was in crisis over the last three years, as it was declining. This means Pakistan is heading toward deindustrialization. This trend continued last year. It is not a good sign for the services sector, which contributes 60 percent of GDP. Large-scale manufacturing ought to be contributing 60 percent to GDP and owing to the fact that manufacturing is going down as well as agriculture, people are now venturing into the services sector. The increase in this sector was 2.9 % whereas the projection was 4.1 %. So, none of the three sectors met their targets.

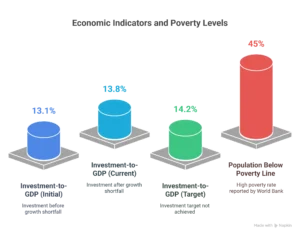

The attempt of the government was to elevate the level of investment as a proportion of GDP. The greater the investment, the faster the economy will develop. This area did improve a little, with the percentage increasing from 13.1 to the desired 14.2. However, this target was not achieved. The World Bank data reveals that 45 percent of the Pakistani population lives below the poverty line. Consequently, austerity measures have led to more poverty. The agricultural sector has also faced difficulties. Agriculture’s contribution to our GDP is 24 percent and the growth rate in this sector was just 0.6 percent, which is way below the desired 2 percent growth. Above all there has been a 13.5 percent reduction in most of the crops. This means negative growth in these crops.

The attempt of the government was to elevate the level of investment as a proportion of GDP. The greater the investment, the faster the economy will develop. This area did improve a little, with the percentage increasing from 13.1 to the desired 14.2. However, this target was not achieved. The World Bank data reveals that 45 percent of the Pakistani population lives below the poverty line. Consequently, austerity measures have led to more poverty. The agricultural sector has also faced difficulties. Agriculture’s contribution to our GDP is 24 percent and the growth rate in this sector was just 0.6 percent, which is way below the desired 2 percent growth. Above all there has been a 13.5 percent reduction in most of the crops. This means negative growth in these crops.

What is the reason for this?

The government attributes this primarily to water shortages. Pakistan has experienced a 40% reduction in water availability. This shows the importance of the government to concentrate on water infrastructure. Six canals are not the point, the point is how do we store water when we have excess, and how do we utilize it when we have a shortage, more so in this season when India has shown the door to the Indus Water Treaty and may use water as a political tool.

The other reasons on the negative side of agriculture are the advice of the IMF to eliminate the minimum support price (MSP) on major crops like wheat, sugarcane, cotton, and fertilizers. The IMF has suggested eliminating MSP by mid-2026. I think that this is partly why agriculture is in decline. The absence of the MSP will make farming riskier, and no one will be willing to invest in commercial crops. It is due to this reason that there has been such dramatic decline of 13.5 percent in major crops. It would be handy for agriculture to restore the MSP at the earliest. But, I wish to see some change in agriculture in the forthcoming year, which may affect the GDP by 1 percent. However, no serious effect can be observed yet.

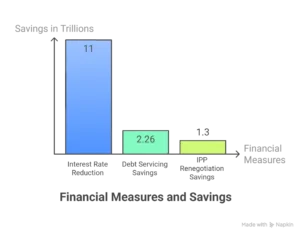

And to see what the general budget is, let us have a look at its details and its current status. The initial point to notice is that government has managed to tame the inflation, bringing it down to less than 5%. Consequently, the policy rate or interest rate has been reduced as well. It was as high as 22%, which has been brought down to 11%. As the interest rates have been cut, the cost of servicing the debt of government has also been lowered considerably. As a matter of fact, this has saved approximately 2.26 trillion rupees. Consequently, the government has gained more fiscal space.

And to see what the general budget is, let us have a look at its details and its current status. The initial point to notice is that government has managed to tame the inflation, bringing it down to less than 5%. Consequently, the policy rate or interest rate has been reduced as well. It was as high as 22%, which has been brought down to 11%. As the interest rates have been cut, the cost of servicing the debt of government has also been lowered considerably. As a matter of fact, this has saved approximately 2.26 trillion rupees. Consequently, the government has gained more fiscal space.

Also, the government has retired some Independent Power Producers (IPPs) and renegotiated with others, purporting to gain 1.3 trillion rupees. I continue to believe that another 1 trillion rupees can be saved through renegotiations once again in case the government concentrates on this.

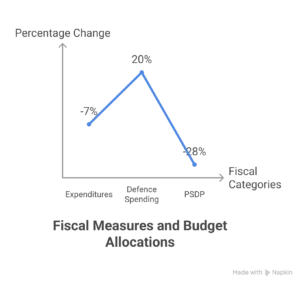

The government has also reduced subsidies by 14%. In addition, the Public Sector Development Program (PSDP) has been cut by 28 percent, from 1.4 trillion rupees to only 1 trillion rupees. But it is well to note that these 1 trillion rupees will be largely targeted by the government on infrastructure rather than on health and education. Interestingly, the PSDP is never fully utilized. It often remains underutilized and gets redistributed in mini-budgets. This is something which has been occurring over the last five years. So long as this crisis is not dealt with, there will be no achievements in the development of the public sector, and the government will not be able to effect an economic stimulus package by investing in the public sector.

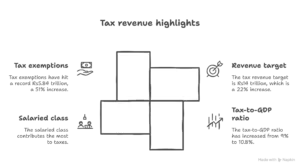

So, we find that the government has cut four major heads: interest payments, savings on renegotiation of IPP, cutting down on subsidies and the cut on PSDP. In these areas, expenditures have decreased by 7%. But it has been seeing an upsurge in military expenditure, which has been increased by 20 percent to 2.55 trillion rupees. On the other hand, taxes have been increased. The target of revenue has been increased to 14 trillion rupees, which is an increment of 22 percent on the part of the FBR. The level of tax to GDP ratio that stood at 9 percent last year has risen to 10.8 percent. More people are paying taxes now compared to before.

So, we find that the government has cut four major heads: interest payments, savings on renegotiation of IPP, cutting down on subsidies and the cut on PSDP. In these areas, expenditures have decreased by 7%. But it has been seeing an upsurge in military expenditure, which has been increased by 20 percent to 2.55 trillion rupees. On the other hand, taxes have been increased. The target of revenue has been increased to 14 trillion rupees, which is an increment of 22 percent on the part of the FBR. The level of tax to GDP ratio that stood at 9 percent last year has risen to 10.8 percent. More people are paying taxes now compared to before.

New taxes, including the Federal Excise Duty (FED) of 655 billion rupees, have also been introduced by the government. But there are reduced taxes including the taxes imposed on salaried people and on real estate, where taxes have been considerably cut down. Though the real estate owners are yet to be contented with these changes, when we examine the contribution to the tax, it is interesting to find that retailers (traders) have paid 26 billion rupees as tax, corporate sector (the richest investors) 11.7 billion rupees and small investors in the non-corporate sector have paid 116 billion rupees in tax. Salaried people were the greatest contributors with 400 billion rupees.

This indicates that the impoverished individuals pay the highest taxes. The rich are able to evade taxes, and the tax exemptions by the government have hit a new high of 5.84 trillion rupees, an increase of 51 percent on 3.8 trillion rupees a year earlier. Typically, these exemptions are given on raw materials and semi-finished products and are meant to promote export-oriented industries. This has the effect of making the rich category pay lower tax compared to the salaried category.

Fiscal deficit is concerned; the current budget observes major cut. Fiscal deficit has been just 2.4 percent of GDP in the last 9 months, and the government is keen on reducing it to 4.8 percent by December. This will only be made possible by the government raising its tax revenue.

Fiscal deficit is concerned; the current budget observes major cut. Fiscal deficit has been just 2.4 percent of GDP in the last 9 months, and the government is keen on reducing it to 4.8 percent by December. This will only be made possible by the government raising its tax revenue.

The level of our debt as a proportion of GDP is now 80 per cent, so that every 100 rupees of national income is accompanied by 80 rupees of debt. Out of this, over 60 per cent is owed to the local banks and about 35 per cent to the foreign banks. For this reason, we are also losing part of our economic sovereignty to international capital.

But this budget is not aggravating the debt position too much. The overall fiscal deficit has been brought down, and with the lowered expenditures and raised taxes, the scope of further bringing down the fiscal deficit is also broadening. But the outstanding message is that it is not a growth budget. It is an austerity budget that aims at containing inflation and the fiscal deficit.

The main purpose of this budget is not, by any means, growth stimulation and development of the public sector. Its primary aim is to tame inflation, decrease fiscal deficit, as well as raise taxes. This will not result in rapid economic growth. That is not a growth budget; that is an austerity budget.

With a cut in spending and a rise in taxation, it can be ascertained that the economy would not expand at the projected rate of 4.2 percent next year. The situation may be altered by other forces such as exports, general economic conditions in the world and agricultural performance as dictated by the laws of economics. However, with the budgetary basis, growth of 4.2 percent is not plausible.

So what is more important is that inflation will not grow, but the fact that unemployment will still be a significant problem. The official statistics indicate a rate of unemployment of 6.2 percent, especially among youths. This is one of the reasons why a lot of youths are going out of the country. The educated are pursuing greener pastures overseas, leading to a brain drain, and the manual workers are also emigrating in pursuit of greener pastures.

So what is more important is that inflation will not grow, but the fact that unemployment will still be a significant problem. The official statistics indicate a rate of unemployment of 6.2 percent, especially among youths. This is one of the reasons why a lot of youths are going out of the country. The educated are pursuing greener pastures overseas, leading to a brain drain, and the manual workers are also emigrating in pursuit of greener pastures.

This budget is not going to introduce any major growth, and employment statistics will not be much better. Those employed are also underemployed in most cases, with wages not commensurate with their qualifications. This has, in turn, led many to move out of the country in search of greater employment opportunities.

It is also an austerity-based budget rather than a growth-based budget. It is dominated by its concern to control inflation, to reduce fiscal deficit and to seek economic stability, but it will not result in high growth and the creation of employment.